WASHINGTON, D.C. 20549

TECOGEN INC.

All stockholders are cordially invited to attend the Annual Meeting of Stockholders, or the Annual Meeting. Only stockholdersAttached to this notice is a Proxy Statement relating to the proposals to be considered at the Annual Meeting. The Board of record of the Company atDirectors has fixed the close of business on April 25, 2016 are15, 2019 (5:00 p.m., U.S. Eastern Time) as the record date, or the Record Date, for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting or at any adjournment or postponement thereof. A complete list of these stockholders will be open for the examination of any stockholder of record during ordinary business hours at the Company's principal executive offices located at 45 First Avenue, Waltham, Massachusetts, 02451 for a period of ten days prior to the Annual Meeting. The list will also be available for the examination of any stockholder present at the Annual Meeting.

Your vote is important. Your prompt response will also help reduce proxy costs and will help you avoid receiving follow-up telephone calls or mailings. Please vote as soon as possible. Also,The Company will be mailing the Company has electedproxy materials to take advantage of the Securities and Exchange Commission rules that allow the Company to furnishstockholders beginning on on about April 26, 2019. The proxy materials will also be available to you and other stockholders on the Internet.

TECOGEN INC.

WHY ARE YOU MAKING THESE MATERIALS AVAILABLE OVER THE INTERNET RATHER THAN MAILING THEM?

Under the "Notice and Access Rule" that the Securities and Exchange Commission, or the SEC, has adopted, we are furnishing proxy materials to our stockholders on the Internet rather than mailing printed copies of those materials to each stockholder. This will help us conserve natural resources and it will save postage, printing and processing costs. If you received the Notice of Internet Availability of Proxy Materials, or the Notice of Internet Availability, by mail, you will not receive a printed copy of our proxy materials unless you specifically request one. Instead, the Notice of Internet Availability will instruct you about how you may (1) access and review the Company's proxy materials on the Internet and (2) access your proxy card to vote on the Internet. We anticipate that we will mail the Notice of Internet Availability to our stockholders on or about May 13, 2016.April 25, 2019.

The Proxy Materials are available at https://materials.proxyvote.com/87876P. Enter the 12-digit control number located on the Notice of Internet Availability, proxy card or proxy card.voter instruction form.

Instructions for requesting a paper copy of the proxy materials are set forth on the Notice of Internet Availability.

Stockholders who owned shares of the Company’s voting stock at the close of business on April 25, 201615, 2019, or the Record Date, are entitled to notice of and to vote at the Annual Meeting on all matters properly brought before the Annual Meeting.

Each share of Common Stock is entitled to one vote on each matter presented at the Annual Meeting.

WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES AS A STOCKHOLDER OF RECORD AND AS A BENEFICIAL OWNER?

Stockholder of Record

If, on the Record Date, your shares were registered directly in your name with our transfer agent, VStock Transfer LLC, you are a “stockholder of record” who may vote at the Annual Meeting. As thea stockholder of record you have the right to direct the voting of your shares via the Internet, returningtelephone, to return a proxy card to us or votingto vote in person at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please vote via the Internet, telephone, or complete, sign, date, and signreturn a proxy card to ensure that your vote is counted.

Beneficial Owner

If, on the Record Date, your shares were held in an account at a brokerage firm or at a bank or other nominee holder, you are considered the beneficial owner of shares held “in street name.” Your broker or nominee is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct your broker, bank, or nominee how to vote your shares by using any voting instruction card supplied by them or by following their instructions for voting by telephone, online, or in person. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from your brokerage firm, bank or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank or other nominee holder.

HOW DOES THE BOARD RECOMMEND THAT I VOTE?

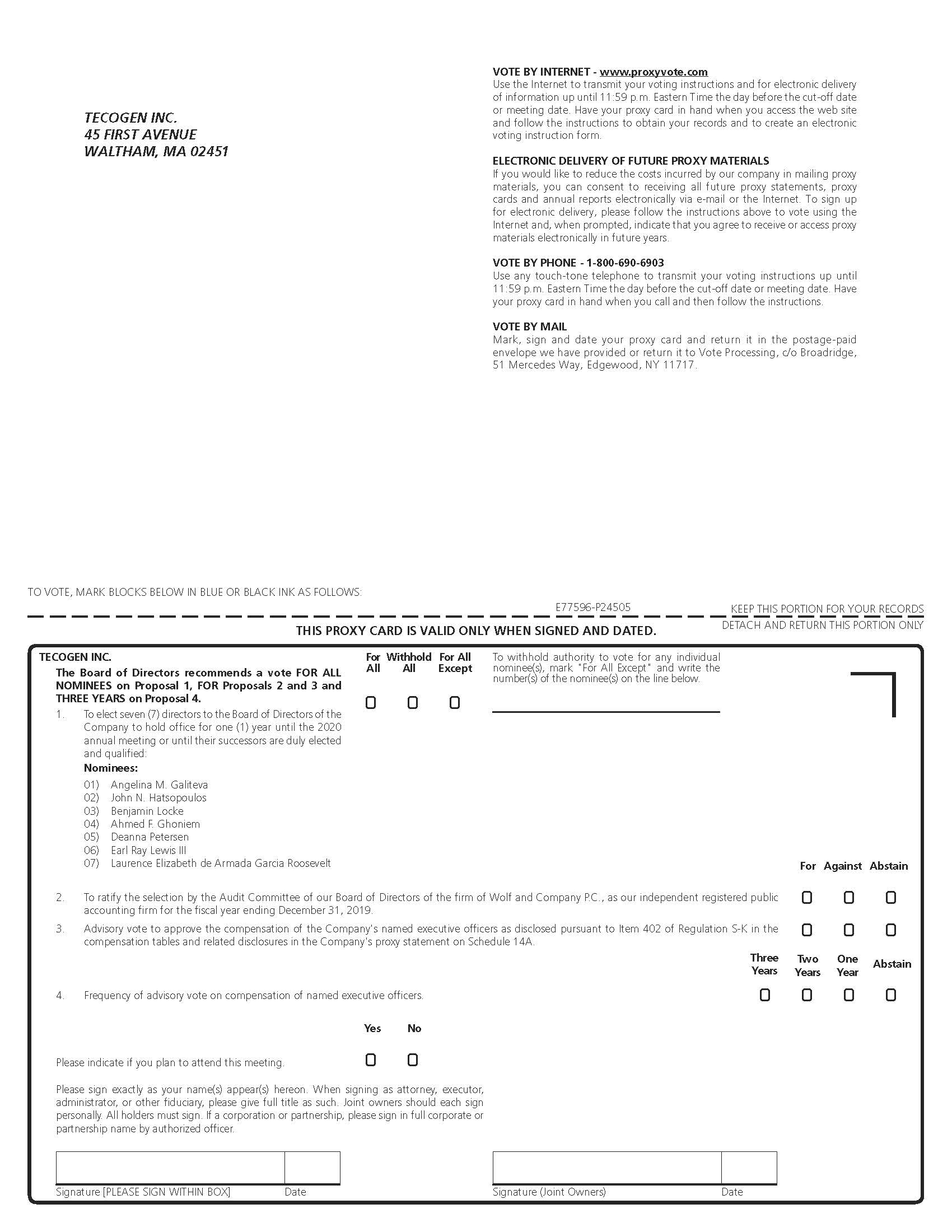

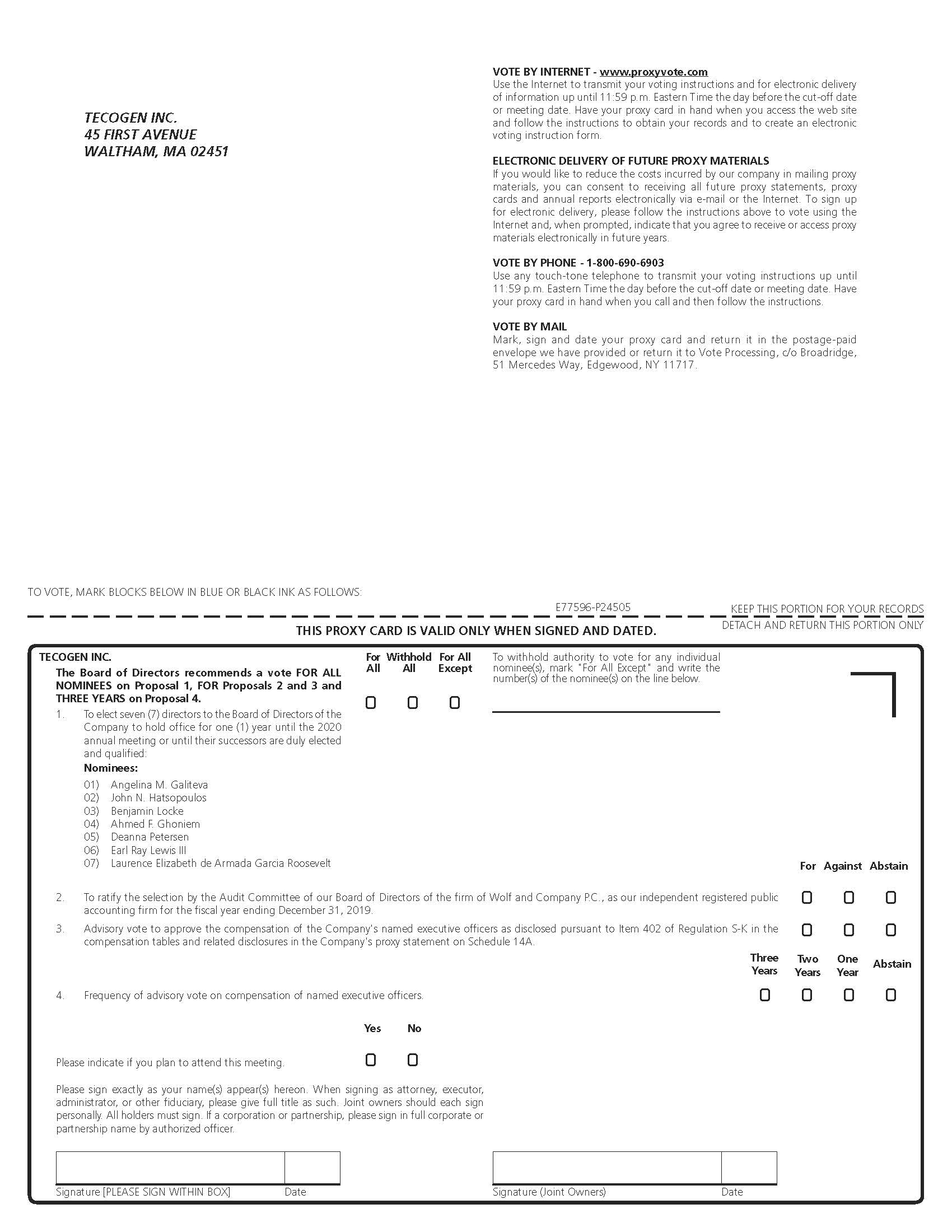

Our Board unanimously recommends that stockholders vote "FOR" all sixseven nominees for director, and "FOR" the ratification of the appointment of Wolf & Company, P.C. as our independent auditors,registered public accountants, "FOR" approval of the compensation of the Company's named executive officers disclosed in this Proxy Statement, and "FOR""THREE YEARS" in the authorization to adjournvote regarding the Annual Meeting to a later date or dates if there are insufficientfrequency of non-binding stockholder advisory votes present in person or represented by proxy aton the Annual Meeting to approvecompensation of the proposals.Company's named executive officers.

WHAT IS THE QUORUM REQUIREMENT?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the issued and outstanding shares are represented by stockholders present at the Annual Meeting or represented by proxy. On the Record Date, there were 19,065,43624,839,656 shares outstanding and entitled to vote.vote at the meeting. Thus, 9,532,71912,419,829 shares must be represented by stockholders present at the meeting or by proxy to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. A broker non-vote occurs when a broker holding shares for a beneficial owner votes on one proposal but does not vote on another proposal because, in respect of such other proposal, the broker does not have discretionary voting power and has not received instructions from the beneficial owner. If there is no quorum, the chairman of the meeting or a majority of the votes present at the meeting may adjourn the meeting to another date.

WHY WOULD THE ANNUAL MEETING BE ADJOURNED?

The Annual Meeting may be adjourned if a quorum is not present or to allow time for further solicitation of proxies in the event there are insufficient votes present in person or represented by proxy to approve the proposals. For purposes of determining whether the stockholders have approved matters other than the election of directors, abstentions are treated as shares present or represented and voting, so abstaining has the same effect as a negative vote. Shares held by brokers who do not have discretionary authority to vote on a particular matter and who have not received voting instructions from their customers are not counted or deemed to be present or represented for the purpose of determining whether stockholders have approved that matter, but they are counted as present for the purpose of determining the existence of a quorum at the Annual Meeting.

HOW DO I VOTE BY PROXY?

WhetherIf you hold shares directly as the stockholder of record, or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. StockholdersSuch stockholders may deliver their proxies either:

| |

| (1) | Electronically over the Internet as outlined in the Notice of Internet Availability; orat www.proxyvote.com; |

| |

| (2) | By requesting,telephone at 1-800-690-6903; or |

| |

| (3) | By completing and submitting a properly signed paper proxy card as outlined in the Notice of Internet Availability.card. |

ReturningIf you are a stockholder of record, returning the proxy card will not affect your right to attend the Annual Meeting and vote in person as described elsewhere herein. If you properly fill in your proxy card and send it to us in time to vote, your proxy (one of the individuals named on your proxy card) will vote your shares as you have directed.

If you sign the proxy card but do not make specific choices, your proxy will vote your shares as recommended by the Board of Directors as follows:

| |

| 1. | FOR the election of each of our Board’sBoard's nominees for director; |

| |

| 2. | FOR the ratification of the appointment of Wolf & Company, P.C. as the Company's independent registered public accounting firm; andfirm. |

| |

| 3. | FOR the authorization to adjournapproval of the Annual Meeting to a later date or dates if there are insufficientcompensation of the Company's named executive officers. |

| |

| 4. | THREE YEARS for the frequency of non-binding stockholder advisory votes present in person or represented by proxy aton the Annual Meeting to approvecompensation of the proposals.Company's named executive officers. |

If any other matters are presented, your proxy will vote in accordance with his or her best judgment. At the time this Proxy Statement was finalized, we knew of no matters that needed to be acted on at the Annual Meeting other than those discussed in this Proxy Statement.

If you are a beneficial owner, you must vote your shares in the manner prescribed by your broker, bank or other nominee. You will receive a voting instruction card (not a proxy card) to use in directing the broker, bank, or other nominee how to vote your shares. You may also have the option to vote your shares via the Internet.

HOW DO I VOTE IN PERSON?

If you are a stockholder of record (i.e., you own the shares directly in your name) and plan to attend the Annual Meeting, you may attend and vote in person on June 23, 2016,6, 2019, or at a later date if the Annual Meeting is adjourned or postponed to a later date, as long as you present valid proof of identification at the Annual Meeting. We will give you a ballot when you arrive. However, if your shares are held in the name of your broker, bank or other nominee, in addition to identification, you must bring proof of beneficial ownership in order to attend the Annual Meeting, which generally can be obtained from the record holder. In that event, you must also obtain a proxy or a power of attorney executed by the broker, bank or other nominee that owns the shares of record for your benefit and authorizing you to vote the shares at the Annual Meeting.

MAY I REVOKECHANGE MY PROXY?VOTE?

If you give a proxy, you may revoke itStockholders of record my change their vote at any time before the proxy is exercised by sending a written notice of revocation or a later-dated proxy to our Secretary, which must be received prior to commencement of the Annual Meeting; by submitting a later-dated proxy via Internet or phone before 11:59 p.m. Eastern Daylight Time on June 5, 2019; or by voting in person at the Annual Meeting. Your attendance at the Annual Meeting in person will not cause your previously granted proxy to be revoked unless you file the proper documentation for it to be so revoked.

If you hold your shares through a broker, bank or other nominee in "street name", you should contact such person prior to the time such voting instructions are exercised.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE PROXY CARD OR VOTING INSTRUCTION CARD?

If you receive more than one proxy card or voting instruction card, it means that you have multiple accounts with brokers, banks or other nominees and/or our transfer agent. Please sign and deliver, or otherwise vote, each proxy card and voting instruction card that you receive. We recommend that you contact your nominee and/or our transfer agent, as appropriate, to consolidate as many accounts as possible under the same name and address. Our transfer agent is exercised. You may revoke your proxy in three ways:Vstock Transfer, LLC, 18 Lafayette Place, Woodmere, NY 11598: Telephone: 212-828-8436.

| |

1. | You may send in another proxy with a later date. |

| |

2. | You may notify the Company in writing (by you or your attorney authorized in writing, or if the stockholder is a corporation, under its corporate seal, by an officer or attorney of the corporation) at our principal executive offices before the Annual Meeting, that you are revoking your proxy. |

| |

3. | You may vote in person at the Annual Meeting. |

WHAT VOTE IS REQUIRED TO APPROVE EACH PROPOSAL?

Proposal 1: Election of Directors. The election of directors shall be determined by a plurality of the votes cast by the stockholders. Therefore, a nominee who receives a plurality, means he has received the highest(the nominee who receives a higher number of votes “for” his or her election than any other nominee for the same director's seatseat) will be elected.

Proposal 2: Ratification of independent registered public accounting firm. The approval of the ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of the holders of a majority in voting power of the votes cast by the holders of all of the shares of stock present or represented at the meeting and voting affirmatively or negativelyAnnual Meeting entitled to vote on suchthe matter.

Proposal 3: AdjournmentAdvisory vote regarding named executive officer compensation included in this Proxy Statement. Approval of the Annual Meeting. The approvalcompensation of the adjournment of the Annual Meeting,Company's named executive officers requires the affirmative vote of the holders of a majority in voting power of the votes cast by the holders of all of the shares of Common Stockstock present or represented by proxy at the Annual Meeting and entitled to vote on the matter. The vote is advisory only and the Board of Directors will determine the compensation of the executive officers of the Company taking into account the results of the advisory vote regarding compensation of the Company's named executive officers.

Proposal 4: Advisory vote regarding the frequency of the advisory vote on approval of the compensation of Company's named executive officers. This vote requires the affirmative vote of the holders of a majority in voting affirmativelypower of the votes cast by the holders of all of the shares of stock present or negativelyrepresented at the Annual Meeting and entitled to vote on suchthe matter. The vote is advisory only and the Board of Directors will take the results of these advisory votes into account in determining the frequency of advisory votes regarding the compensation of the Company's named executive officers.

HOW ARE VOTES COUNTED?

Proposal 1: You may either vote “FOR” or “WITHHOLD” authority to vote for each of the nominees for the Board of Directors. Shares present at the meeting or represented by proxy where the shareholderstockholder does not vote for a nominee or properly withholds authority to vote for such nominee and broker non-votes will not be counted toward"For" or "Against" such nominee's achievement of a plurality.

Proposal 2: You may vote “FOR,” “AGAINST” or “ABSTAIN” on the ratification of Wolf & Company, P.C. If you abstain from voting on the proposal to ratify Wolf & Company, P.C., your vote will have no effect on the outcome of the vote on the proposal. Brokers, bankers and other nominees have discretionary voting power on this routine matter and, accordingly, broker non-votes will have no effect on the vote for this proposal.

Proposal 3: You may vote “FOR,” “AGAINST” or “ABTAIN”“ABSTAIN” on the proposal to authorize adjournmentadvisory vote regarding the compensation of the Annual Meeting. If you abstain from votingCompany's named executive officers.

Proposal 4: You may vote “THREE YEARS,” “TWO YEARS, ” "ONE YEAR," or “ABSTAIN” on the proposal to authorize adjournmentadvisory vote regarding the frequency of stockholder advisory votes on the compensation of the Annual Meeting, your vote will have no effect on the outcome of the proposal. Broker non-votes will have no effect on the vote for this proposal.Company's named executive officers.

ARE THERE ANY DISSENTERS' RIGHTS OF APPRAISAL?

Our Board is not proposing any action for which the laws of the State of Delaware, the Company’s Certificate of Incorporation or the Company's Bylawsby-laws provide a right of a stockholder to dissent and obtain appraisal of or payment for such stockholder's shares.

WHO BEARS THE COST OF SOLICITING PROXIES?

The Company will bear the cost of soliciting proxies in the accompanying form and will reimburse brokerage firms and others for expenses involved in forwarding proxy materials to beneficial owners or soliciting their execution.

WHERE ARE THE COMPANY'S PRINCIPAL EXECUTIVE OFFICES?

The Company’s principal executive offices are located at 45 First Avenue, Waltham, Massachusetts, 02451, and the Company's telephone number is (781) 466-6400.

HOW CAN I OBTAIN ADDITIONAL INFORMATION ABOUT THE COMPANY?

The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015,2018, or the Annual Report, has been made available on the Internetis being sent to all stockholders entitled to vote at the Annual Meeting and who received the Notice of Internet Availability. Additional copies will be furnished without charge to stockholders upon written request.along with this proxy statement. Exhibits to the Annual Report will be provided upon written request and payment of an appropriate fee. All written requests should be directed to the Secretary of the Company c/o Tecogen Inc., 45 First Avenue, Waltham, Massachusetts 02451. The Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Our website address is included several times in this Proxy Statement as a textual reference only and the information in the website is not incorporated by reference into this Proxy Statement.

INFORMATION ABOUT DIRECTORS AND EXECUTIVE OFFICERS

The following table lists the current members of our Board, and our executive officers. The address for our directors and officers is c/o Tecogen Inc., 45 First Avenue, Waltham, Massachusetts 02451. Mr. Maxwell and Mr. Davidson have decided not to continue to serve as directors following the 2019 Annual Meeting. Also listed below are Mr. Earl R. Lewis III and MS. Garcia Roosevelt who are being nominated for election as directors at the 2019 Annual Meeting.

| | | Name | Age | Position(s) | (1) | (2) | (3) | Age | Position(s) | (1) | (2) | (3) |

| Angelina M. Galiteva | 49 | Chairperson of the Board and Director | x |

| 52 | Chairperson of the Board and Director | x |

|

| John N. Hatsopoulos | 82 | Co-Chief Executive Officer and Director | | 85 | Lead Director | |

| Benjamin M. Locke | 48 | Co-Chief Executive Officer | | 51 | Director & Chief Executive Officer | |

| Robert A. Panora | 61 | Chief Operating Officer and President | | 64 | Chief Operating Officer and President | |

| David A. Garrison | 48 | Chief Financial Officer, Treasurer and Secretary | | |

| Joseph E. Aoun | 63 | Director |

| x | |

| Bonnie Brown | | 56 | Chief Accounting Officer, Treasurer and Secretary | |

| Keith Davidson | | 68 | Director |

|

| Ahmed F. Ghoniem | 64 | Director | x |

| x | 67 | Director |

| x |

| Earl R. Lewis | 72 | Director |

| x |

| |

| Charles T. Maxwell | 84 | Director | x |

| x | 87 | Director | x |

| x |

| | | |

| Deanna Petersen | | 57 | Director | x |

| Earl R. Lewis III | | 75 | Nominated for Election as a Director | |

| Laurence Garcia Roosevelt | | 41 | Nominated for Election as a Director | |

| (1) Member of Audit Committee | (1) Member of Audit Committee | | (1) Member of Audit Committee | |

| (2) Member of Compensation Committee | (2) Member of Compensation Committee | | (2) Member of Compensation Committee | |

| (3) Member of the Nominating and Governance Committee | (3) Member of the Nominating and Governance Committee | | (3) Member of the Nominating and Governance Committee | |

Angelina M. Galiteva, age 49,52, has been ourthe Company's Chairperson of the Boardboard of directors since 2005. SheMs. Galiteva is founder and Chair of the founder ofBoard for the Renewables 100 Policy Institute.Institute, a non-profit entity dedicated to the global advancements of renewable energy solutions since 2008. She is also serves as the Chairperson forat the World Council for Renewable Energy. Both organizations are dedicatedEnergy (WCRE), which focuses on the development of legislative and policy initiatives to facilitate the successful deploymentintroduction and growth of renewable energy technologies andsince 2003. Since 2011, she has served on the policies that support the transition to a carbon free grid on a global scale.

In 2011 Ms. Galiteva was appointed by California’s Governor and confirmed by the State Senate to the 5 member Board of Governors of the California Independent System Operator Corporation. She was reappointed by the Governor(CA ISO), providing direction and again reconfirmed by the Senate in 2014. The Independent System Operator is responsibleoversight for the reliable operation ofCA ISO which operates the power grid in the state of California and for the efficient operation of the electricity market, includinggrid. Also, she is a principal at New Energy Options, Inc., a company focusing on advancing the integration of renewablesustainable energy projects as mandated by State Law.

In addition Ms. Galiteva, issolutions since 2006. She has also been a Principal at NEOptions, Inc., a renewable energystrategic consultant with Renewable Energy Policy and new technology product design and project development firm. Her industry experience includes serving as Executive Director of the Los Angeles Department of Water and Power and head of its Green LA, Environmental Affairs and New Product Development Organization. While at the largest municipal utility in the Western US, she was responsible for strategic positioning and the environmental compliance departments. Her career also includes working with the New York Power Authority as well as advising numerous renewable energy, energy efficiency, and new product development firms. Ms. Galiteva enjoys working to structure and advance the implementation of cutting edge energy policies and programs that reflect the increasing role of renewable energy, storage, mobility and distributed energy technologies worldwide.

Strategy Consulting since 2004. Ms. Galiteva holds a Master’s degreeM.S in Environmental and Energy Law, and a law degreeJ.D. from Pace University School of Law, and a bachelor’s degreeB.S. from Sofia University in Bulgaria. Ms. Galiteva is currently serving a one-year term as the Company's Chairperson and as a director. Ms. Galiteva is also a member of Tecogen's Audit Committee and a member of Tecogen's Compensation Committee.

OurTecogen's Board has determined that Ms. Galiteva’s prior experience in the energy field qualifies her to be a member of the Board in light of the Company’s business and structure.

John N. Hatsopoulos, age 82, has been the Chief Executive Officer of the Company since the organization of the Company in 2000, and has shared the role as Co-Chief Executive Officer since the fall of 2014. He85, has been a member of the BoardCompany's board of directors since its founding.founding in 2000 (other than the period between June 6, 2018 and February 1, 2019) and was Tecogen's Co-Chief Executive Officer until March 29, 2018. He has also beenwas the Co-Chief Executive Officer of American DG Energy Inc., (NYSE MKT: ADGE), or American DG Energy, a publicly traded companyADGE, until ADGE merged with the Company in May of 2017, or the On-Site Utility business since 2000,ADGE Merger, and was on the board of directors of ADGE until March 29, 2018. Mr. Hatsopoulos was the Chairman of EuroSite Power Inc., or Eurosite Power, a subsidiaryformer affiliate of American DG Energy Inc. since 2009.the Company, from 2009 until 2016. Mr. Hatsopoulos is a co-founder of Thermo Electron Corporation, which is now Thermo Fisher Scientific (NYSE: TMO), and isScientific. He was formerly the retired President and Vice Chairman of the Board of Directors of that company. He is a member of the Board of Directors of Ilios Inc., and is a former Member of the Corporation of Northeastern University. The Company, American DG Energy, and EuroSite Power are affiliated companies by virtue of common ownership. Mr. HatsopoulosHe graduated from Athens College in Greece and holds a bachelor’s degreeB.S. in history and mathematics from Northeastern University, as well as honorary doctorates in business administration from Boston College and Northeastern University.

On February 1, 2019 Mr. Hatsopoulos was reappointed by the Board as a director and he is currently serving as Lead Director to identify and evaluate financing alternatives for the Company’s Co-Chief Executive Officer and is also the Co-Chief Executive Officer of American DG Energy and the Chairman of Eurosite Power. On average, Mr. Hatsopoulos spends approximately 50% of his business time on the affairs of the Company; however such amount varies widely depending on the needs of the business and is expected to increase as the business of the Company develops.

Our Board has determined that Mr. Hatsopoulos’ prior experience as co-founder, president and Chief Financial Officer of Thermo Electron Corporation, where he demonstrated leadership capability and gained extensive expertise involving complex financial matters, and his extensive knowledge of complex financial and operational issues qualify him to be a member of our Board in light of the Company’s business and structure.

Company.

Benjamin M. Locke, age 48,51, has been oura member of the Company's board of directors since June 2018. Mr. Locke has been the Company's Co-Chief Executive Officer since 2014.2014 and as of March 29, 2018 he became the sole Chief Executive Officer of Tecogen. Mr. Locke joined the Company in June, 2013 aswas the Director of Corporate Strategy for Tecogen and was promoted to General Manager prior to his appointment as Co-CEO.Co-Chief Executive Officer of Tecogen. In October of 2014, Mr. Locke began serving as Co-Chief Executive Officer of American DG Energy. He splits his time betweenADGE and continued to serve as Co-Chief Executive Officer until the two companies.completion of the ADGE Merger. Previously, Mr. Locke was the Director of Business Development and Government Affairs at Metabolix, (NASDAQ:MBLX), a bioplastics technology development

and commercialization company. In that role, he was responsible for developing and executing plans for partnerships, joint ventures, acquisitions, and other strategic arrangements for commercializing profitable clean energy technologies. Prior to joining Metabolix in 2001, Mr. Locke was Vice President of Research at Innovative Imaging Systems, or IISI, a high-technology R&D company. At IISI, he drove the development and implementation of growth strategies for the funding of specialty electronic systems for the United States Government. Mr. Locke has a B.S. in Physics from the University of Massachusetts, ana M.S. in Electrical Engineering from Tufts University, and an M.B.A. in Corporate Finance from Boston University.

Tecogen's Board has determined that Mr. Locke's prior experience and education qualify him to be a member of our Board in light of the Company's business and structure.

Robert A. Panora, age 61,64, has been ourthe Company's Chief Operating Officer and President since the organization of the Company in 2000 and the Chief Operating Officer of Ilios since its inception in 2009.2000. In August of 2015, Mr. Panora began serving as Director of Operations of American DG Energy. He splits his time betweenEnergy and continued to serve as Director of Operations until the two companies.completion of the ADGE Merger. On March 29, 2018, Mr. Panora was appointed as the sole director of ADGE. Before this role, since 1990, he had been General Manager of the Company’s Product Group while a division of Thermo Electron Corporation since 1990, and Manager of Product Development, Engineering Manager, and Operations Manager since 1984. Over his 31-year tenure with the Company and its predecessors, Mr. Panora has been responsible for sales and marketing, engineering, service, and manufacturing. Mr. Panora contributed to the development of Tecogen’s first product, the CM-60 cogeneration system, and was Program Manager for the cogeneration and chiller projects that followed. Mr. Panora has had considerable influence on many aspects of the business, from building the employee team, to conceptualizing product designs and authoring many of the original business documents, sales tools, and product literature pieces. Mr. Panora has a bachelor’sB.S. and master’s degreesM.S. in Chemical Engineering from Tufts University.

David A. GarrisonBonnie Brown, age 48,56, has been ourthe Company's Chief FinancialAccounting Officer, Treasurer and Secretary since May of 2017, becoming a member of the management team after the ADGE Merger. Previously, Ms. Brown served as ADGE's Chief Financial Officer from September 2015 until completion of the ADGE Merger. She also served as EuroSite Power Inc's Chief Financial Officer from September of 2015 until January 20, 2017. Ms. Brown was a Financial Advisor at Barker Financial Group, a strategic wealth management advisory company, from July 2014 to September 2015. She joined Tecogen as its Controller in 2005 and became the Chief Financial Officer in 2007 and remained in that position until December 2014. She served from its inception in 2009 to December 2014 as the Chief Financial Officer of Ilios since 2014.Inc. Prior to joining Tecogen, Ms. Brown was a partner at Sullivan Bille PC, a regional accounting firm, for 15 years where she provided financial, accounting, audit, tax, and business consulting services for mid-sized companies. Ms. Brown has also worked at Enterprise Bank and Trust as project manager for special assignments including branch acquisitions and information systems transitions in the Company, Mr. Garrison was Executive Vice Presidenttrust department eventually serving as Internal Audit Director, establishing an in-house audit function. She has also provided independent contractor services for a wide variety of publicly traded and Chief Financial Officer of Arrhythmia Research Technology, Inc. (NYSE:HRT)closely held companies, including consulting, internal control and its subsidiary Micron Products, Inc. since 2002. Leading the finance department of Arrhythmia Research Technology, Inc., Mr. Garrison oversaw all aspects of SECSarbanes-Oxley compliance internal controlsservices. Ms. Brown is a CPA and raising capital through debt in a capital intensive medical device manufacturing business. Prior to Arrhythmia, Mr. Garrison spent nine years as Controller and Chief Financial Officer of H & R 1871, Inc., a privately held manufacturer of consumer products. Mr. Garrison holds a B.S. in FinanceAccountancy from Miami UniversityBentley College and a M.B.A.M.S. in Computer Information Systems from Boston University.University

Joseph E. AounKeith Davidson, age 63,68, has been a member of our Board since 2011. He has been President of Northeastern University since 2006. President Aoun is recognized as a leader in higher education policy and served on the Company's board of directors since 2016. Mr. Davidson is President of DE Solutions Inc., a consulting and engineering firm serving the distributed energy markets. With over 25 years of experience in the energy industry, Mr. Davidson has focused on environmental technology development, feasibility studies, product commercialization, application engineering, economic analysis and market development. Prior to joining DE Solutions, Mr. Davidson was President of Energy Nexus Group and Senior Vice President of Onsite Energy Corp. He served as a Director of the Gas Research Institute for over a decade, was past President of the American Council on EducationCogeneration Association, served as well as the Boston Private Industry Council, Jobs for Mass, and the New England Council. He is a memberChair of the ExecutiveNational Association of Energy Service Companies' Distribution Generation Committee, of the Greater Boston Chamber of Commerce, a member of the Massachusetts Business Roundtable, and serves as co-chair of the City to City Boston initiative. Dr. Aoun is the recipient of numerous honorsseveral industry honors. Mr. Davidson is currently active in the California Clean DG Coalition and awardsthe US Combined Heat and is an internationally known scholar in linguistics. Dr. AounPower Association. He holds a master’s degreeM.S in Oriental LanguagesMechanical Engineering from Stanford University and Literaturea B.S. from Saint Joseph University, Beirut, Lebanon, a Diploma of Advanced Study in General and Theoretical Linguistics, fromthe University of Paris VIII, Paris, France,Missouri, Rolla. Mr. Davidson has a long history with Tecogen, actively supporting new business initiatives as well as being instrumental in securing utility and government funding to support product development, including the Ultera technology. Mr. Davidson is currently serving a Ph.D. in Linguistics and Philosophy from MIT.one year term as a Tecogen director, but has decided not to continue to serve as a Tecogen director following the 2019 Annual Meeting of Stockholders.

OurTecogen's Board has determined that Dr. Aoun’s prior experience as the President of Northeastern University and hisMr. Davidson's prior experience in the energy sector and prior associations in the energy industry qualify him to be a member of our Board of Directors in light of the Company's business and structure.

Ahmed F. Ghoniem, age 64,67, has been a member of our Boardthe Company's board of directors since 2008. HeDr. Ghoniem is the Ronald C. Crane Professor of Mechanical Engineering at MIT. He is also the directorDirector of the Center for 21st Century Energy, and Propulsion Researchthe head of Energy Science and Engineering at MIT, where he plays a leadership role in many energy-related activities, initiatives and programs. Mr. GhoniemHe joined MIT as an assistant professorAssistant Professor in 1983. He is an associate fellow of the American Institute of Aeronautics and Astronautics, and Fellow of American Society of Mechanical Engineers. Recently, heHe was recently granted the KAUST Investigator Award. He is a member of the Boards of Directors of EuroSite Power, and Ilios, which are affiliated companies by virtue of common ownership. Mr.Dr. Ghoniem holds a Ph.D. in Mechanical Engineering from the University of California, Berkeley, and ana M.S. and B.S. in Mechanical Engineering from Cairo University. Dr. Ghoniem is currently serving a one year term as a Tecogen director. Dr. Ghoniem is also a member of Tecogen's Nominating and Governance Committee.

Our

Tecogen's Board has determined that Mr. Ghoniem’s prior experience as a Professor of Mechanical Engineering at MIT and his prior experience in the energy sector qualify him to be a member of the Board of Directors in light of the Company's business and structure.

Earl R. Lewis, age 72, has been a member of our Board since 2014. He presently serves as Chairman of the Board of Harvard Bio Science. From 2000 to 2013, Mr. Lewis served as Chairman, CEO and President of FLIR Systems Inc., a company Forbes several times rated in The Top 200 Best Small Companies. He continues to serve as Chairman of the Board of FLIR Systems Inc. Mr. Lewis served for many years as a top level executive at Thermo Electron Inc. companies, including Thermo Instrument Systems, Thermo Optek Corp. and Thermo Jarrell Ash Corp. Mr. Lewis is a Trustee of Clarkson University. Mr. Lewis holds a B.S. in Technology from Clarkson College and has studied Management at Harvard University and Northeastern University.

Our Board has determined that Mr. Lewis’s prior success managing technology companies and his experience serving as a chairman or director on the boards of several companies qualify him to be a member of our Board in light of the Company's business and structure.

Charles T. Maxwell, age 84,87, has been a member of our Boardthe Company's board of directors since 2001. HeMr. Maxwell is a widely recognized expert in the energy sector, with over 40 years of experience with major oil companies and investment banking firms. From 1999 until his retirement in 2012, Mr. Maxwell was a Senior Energy Analyst with Weeden & Co. of Greenwich, Connecticut, where he developed strategic data and forecasts on oil, gas, and power markets. Mr. Maxwell iswas a member of the Board of Directors of American DG Energy, an affiliated company by virtueADGE until the completion of common ownership.the ADGE Merger. Mr. Maxwell holds a bachelor’s degreeB.S. in political sciencePolitical Science from Princeton University and holds a B.A. from Oxford University as a Marshall Scholar in Middle East literature and history. Mr. Maxwell is currently serving a one-year term as a Tecogen director, but has decided not to continue to serve as a Tecogen director following the 2019 Annual Meeting of Stockholders. Mr. Maxwell is also a member of Tecogen's Audit Committee and a member of its Nominating and Governance Committee.

OurTecogen's Board has determined that Mr. Maxwell’s prior experience in the energy sector and his extensive experience as a director of public companies qualifies him to be a member of our Board in light of the Company’s business and structure.

Deanna Petersen, age 57, has been a member of the Company's board of directors since 2017. Ms. Petersen has been Chief Business Officer at AvroBio since January of 2016. She was Vice President of Business Development for Shire Human Genetic Therapies from 2009 until 2015, where she initiated and managed partnering, licensing and merger and acquisition activities worldwide. From 2002 to 2009, Ms. Petersen was Vice President of Business Development for Agenus Inc., and from 1998 to 2002 she was Vice President and Executive Director of Business Development at Coley Pharmaceutical Group, Inc. Ms. Petersen was on the board of ADGE until completion of the ADGE Merger. Ms. Petersen is on the board of directors for the Massachusetts Biotechnology Association and was previously the Treasurer of the board of directors for the Healthcare Business Women’s Association, Boston Chapter. Ms. Petersen holds a B.S. in Biology from Iowa State University and a M.B.A. from the University of Iowa. Ms. Petersen is currently serving a one year term as a director of Tecogen. Ms. Petersen is also a member of Tecogen's Audit Committee and Compensation Committee.

Tecogen's Board has determined that Ms. Petersen’s prior experience in senior operating positions at various companies, where she demonstrated leadership capability and garnered extensive expertise involving complex financial matters, qualify her to be a member of the Board in light of the Company’s business and structure.

Earl R. Lewis III, age 75, has served as Chairman of the Board and as Chief Executive Officer and President of FLIR Systems from 2000 through May 2013, and since May 2013 as Chairman of the Board and as a senior consultant to FLIR Systems. Mr. Lewis also served as Chairman of the Board of Harvard Bio Science from 2013 through June 2018, as CEO and President of Thermo Instrument Systems from 1998 to 2000, as President in 1997, and as COO in 1996. Mr. Lewis also served as CEO and President of Thermo Optek Corporation from 1994 to 1996, as President of Thermo Jarrell Ash Corporation from 1988 to 1994, and in senior operations and manufacturing roles at Thermo Jarrell Ash since 1984 and at other companies in previous years. Mr. Lewis holds a B.S. from Clarkson College of Technology.

Tecogen's Board has determined that Mr. Lewis' extensive leadership experience in senior positions at FLIR Systems, Harvard Bio Science, Thermo Instrument Systems, Thermo Optek Corporation, Thermo Jarrell Ash, and elsewhere qualifies him to be a member of the Board.

Laurence E. de Armada Garcia Roosevelt, age 41, has two decades of experience in strategic marketing, communications and business development. Ms. Garcia Roosevelt currently serves as the Managing Director of the Centennial Office and member of the President’s Cabinet at Babson College. She has significant experience in investor relations and working with companies on capital raising, including initial public offerings (IPOs), and mergers and acquisitions. She previously served as Vice President, Head of Marketing & Communications and a Relationship Manager at Deltec Bank & Trust Limited, at Deltec, where she was Vice President at Weber Shandwick, one of the world’s leading public relations firms where she lead global programs that strengthened reputation and delivered new business for clients, and as the Director of Marketing & Communications for WHERE, Inc. (now PayPal Media Network). Ms. Garcia Roosevelt holds a B.S. in political science from Davidson College, an M.S. in Education, magna cum laude from Hunter College, and an MBA with honors from Simmons College School of Management.

Tecogen's Board has determined that Ms. Garcia Roosevelt’s prior experience in senior positions where she demonstrated leadership capability and garnered extensive expertise involving strategic marketing, business development, fundraising, and investor relations matters qualify her to be a member of the Board in light of the Company’s business and structure.

Each executive officer is elected or appointed by and serves at the discretion of our Board. The elected officers of the Company will hold office until their successors are duly elected and qualified, or until their earlier resignation or removal.

There are no arrangements or understandings between any of Tecogen's directors or officers and any other individuals regarding why that Tecogen director or officer was selected to serve as a director.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Beneficial Owners of at Least Five Percent of our Common Stock

The following table shows,sets forth, as of April 15, 2019, certain information with respect to the bestbeneficial ownership of Tecogen's shares of common stock by (1) any person (including any “group” as set forth in Section 13(d)(3) of the Exchange Act) known by us to be the beneficial owner of more than five percent (5%) of any class of Tecogen's voting securities, (2) each director, (3) each of the named executive officers and (4) all of our knowledge, all persons we know to be beneficial ownerscurrent directors and executive officers as a group. The percentages in the following table are based on 24,839,656 shares of five percent or more of the voting securities of the Companycommon stock issued and outstanding as of the Record Date.April 15, 2019.

|

| | | | | |

| Name and Address of Beneficial Owner | | Common Stock Beneficially Owned(1) | | Percent of Class(1) |

John N. Hatsopoulos (2) | | 3,846,165 |

| | 20.2% |

George N. Hatsopoulos (3) | | 3,605,541 |

| | 18.9% |

Michaelson Capital Special Finance Fund LP(4) | | 1,197,536 |

| | 6.3% |

|

| | | | | |

Name and address of beneficial owner(1) | Number of Shares Beneficially Owned(2) | | % of Shares Beneficially Owned |

| 5% Stockholders: | | | |

George N. Hatsopoulos and Mrs. Daphne Hatsopoulos(3) | 2,744,385 |

| | 11.04 | % |

John N. Hatsopoulos(4) | 2,322,596 |

| | 9.35 | % |

The Hatsopoulos 2012 Family Trust(5) | 2,250,000 |

| | 9.06 | % |

The John N. Hatsopoulos 1989 Family Trust(6) | 1,620,664 |

| | 6.52 | % |

Tryfon Natsis and Despina Pantopoulou Natsis(7) | 1,616,673 |

| | 6.51 | % |

| | | | |

| Directors (& Nominees) & Officers: | | | |

John N. Hatsopoulos(4) | 2,322,596 |

| | 9.35 | % |

Benjamin Locke(8) | 290,218 |

| | 1.2 | % |

Robert Panora(9) | 276,573 |

| | 1.1 | % |

Charles T. Maxwell(10) | 249,590 |

| | 1.1 | % |

Keith Davidson(11) | 84,044 |

| | *% |

|

Angelina M. Galiteva(12) | 75,000 |

| | *% |

|

Ahmed Ghoniem(13) | 62,723 |

| | *% |

|

Bonnie Brown(14) | 25,962 |

| | *% |

|

Deanna Petersen(15) | 9,200 |

| | *% |

|

Earl R. Lewis III(16) | — |

| | |

Laurence Garcia Roosevelt(16) | — |

| | |

| All executive officers and directors as a group (11 persons) | 3,395,906 |

| | 13.3 | % |

* represents less than 1%

| |

(1) | The address of the executive officers and directors listed in the table above is: c/o Tecogen Inc., 45 First Avenue, Waltham, Massachusetts, 02451. |

| |

(2) | Unless otherwise noted in these footnotes, the Company believes that all shares referenced in this table are owned of record by each person named as beneficial owner and that each person has sole voting and dispositive power with respect to the shares of Common Stock owned by each of them. |

| |

(2)

| This information is as of April 25, 2016. It is based on a Schedule 13G filed by John N. Hatsopoulos with the SEC on February 16, 2016, or the "John Hatsopoulos Schedule 13G", and on a Form 4 filed by John N. Hatsopoulos on April 25, 2016, or the "John Hatsopoulos Form 4". In accordance with the disclosures set forth in the John Hatsopoulos Schedule 13G, and John Hatsopoulos Form 4, Mr. John Hatsopoulos reports sole voting power over 2,262,436 shares, sole dispositive power over 2,262,436 shares, shared voting power over 1,583,729 shares and shared dispositive power over 1,583,129 shares. The percent owned is based on the shares listed above and a calculation using the total outstanding shares on April 25, 2016. Based on the information provided in the John Hatsopoulos Schedule 13G, the address of John Hatsopoulos is c/o Tecogen Inc., 45 First Avenue, Waltham, MA 02451. |

| |

(3)

| This information is as of April 25, 2016. It is based on a Schedule 13G filed by George N. Hatsopoulos with the SEC on February 18, 2015, or the "George Hatsopoulos Schedule 13G" and on a Form 4 filed by George N. Hatsopoulos on April 25, 2016, or the "George Hatsopoulos Form 4". In accordance with the disclosures set forth in the George Hatsopoulos Schedule 13G and George Hatsopoulos From 4, Mr. George Hatsopoulos reports sole voting power over 2,300,890 shares, sole dispositive power over 2,300,890 shares, shared voting power over 1,304,651 shares and shared dispositive power over 1,304,651 shares. The percent owned is based on the shares listed above and a calculation using the total outstanding shares on April 25, 2016. Based on the information provided in the George Hatsopoulos Schedule 13G, the address of George Hatsopoulos is c/o Tecogen Inc., 45 First Avenue, Waltham, MA 02451. |

| |

(4)

| This information is as of December 31, 2015 and is based solely on a Schedule 13G filed by Michaelson Capital Special Finance Fund LP with the SEC on February 19, 2016, or the “Michaelson Schedule 13G". In accordance with the disclosures set forth in the Michaelson Schedule 13G, Michaelson Capital Special Finance Fund LP reports shared voting power over 1,197,536 shares and shared dispositive power over 1,197,536 shares. The percent owned is based on the shares listed above and a calculation using the total outstanding shares on April 25, 2016. Based on the information provided in the Michaelson Schedule 13G, the address of Michaelson Capital Special Finance Fund LP is 509 Madison Avenue, Suite 2210, New York, NY 10022. |

Security Ownership of Directors and Executive Officers

The following table shows the amount of our Common Stock owned by each director and director nominee, the Named Executive Officers as defined below, and by all of the present executive officers and directors as a group as of the Record Date.

|

| | | | | | |

Name and address of beneficial owner(1) | | Amount and Nature of Beneficial Ownership(2) | | Percent of Class(3) |

John N. Hatsopoulos (4) | | 3,846,165 |

| | 20.2 | % |

Robert A. Panora (5) | | 288,350 |

| | 1.5 | % |

Charles T. Maxwell (6) | | 100,000 |

| | *% |

|

Angelina M. Galiteva (7) | | 75,000 |

| | *% |

|

Ahmed F. Ghoniem (8) | | 50,000 |

| | *% |

|

David A. Garrison (9) | | 33,500 |

| | *% |

|

Benjamin Locke (10) | | 68,750 |

| | *% |

|

Joseph E. Aoun (11) | | 12,500 |

| | *% |

|

Earl Lewis (12) | | 6,250 |

| | *% |

|

| All executive officers and directors as a group (8 persons) | | 4,474,265 |

| | 23.1 | % |

| |

* | Designates less than 1% of beneficial ownership. |

| |

(1)

| Unless otherwise specified, the address of each of our directors, nominees for directors, Named Executive Officers and executive officers is c/o Tecogen Inc., 45 First Avenue, Waltham, MA 02451. |

| |

(2)

| In accordance with Rule 13d-3 under the Exchange Act, each person’sperson's percentage ownership is determined by assuming that the options and warrants to purchase common stock that are held by that person, and which are exercisable within 60 days, have been exercised. |

| |

(3) | NumberBased solely upon the Schedule 13G/A filed by Dr. George Hatsopoulos and Mrs. Daphne Hatsopoulos on May 16, 2018. (Dr. Hatsopoulos died on or about September 20, 2018.) The Schedule 13G/A states the beneficial ownership of outstandingDr. Hatsopoulos as the following: (1) 1,812,468 shares of common stock held directly by Dr. Hatsopoulos; (2) 154,760 shares of common stock held by Dr. Hatsopoulos and his wife Daphne Hatsopoulos as joint tenants; (3) 320,179 shares of Common Stock held in The Hatsopoulos 1994 Family Trust for the Benefit of Nicholas Hatsopoulos, of which Mrs. Hatsopoulos and Mr. Joseph Comeau are trustees, and (4) 456,978 shares of Common Stock held in The Hatsopoulos 1994 Family Trust for the Benefit of Marina Hatsopoulos, of which Mrs. Hatsopoulos and Mr. Michael Bass are trustees. The address of the Record Date and used in the calculation of percent of classholder is 19,065,436.

233 Tower Road, Lincoln, MA 01773. |

| |

(4) | Includes:Based solely upon: (a) 2,135,210 shares of Common Stock heldthe Schedule 13G/A filed by J&P Enterprises LLC for the benefit of: (1)Mr. John N. Hatsopoulos on March 26, 2019 and (2) Patricia L. Hatsopoulos. John N.the Form 4/A filed by Mr. Hatsopoulos on April 11, 2018. Based on the Schedule 13G/A and Form 4/A the beneficial ownership of Mr. Hatsopoulos is the Executive Member of J&P Enterprises LLC and has voting and investment power; (b) 593,770 shares of Common Stock held by John N. Hatsopoulos and his wife, Patricia L. Hatsopoulos, as joint tenants with rights of survivorship, each of whom share voting and investment power; (c) 989,859 shares of Common Stock held by The John N. Hatsopoulos Family Trust 2007 for the benefit of:following: (1) Patricia L. Hatsopoulos, (2) Alexander J. Hatsopoulos, and (3) Nia Marie Hatsopoulos, for which George N. Hatsopoulos and Patricia L. Hatsopoulos are the trustees; (d) 100 shares of Common Stock held by Patricia L. Hatsopoulos, John N. Hatsopoulos's wife; and (e) 127,226155,351 shares of common stock that Johnheld directly by Mr. Hatsopoulos; (2) 1,039,480 shares of common stock held by the Nia M. Hatsopoulos owns directly in his name.Jephson 2011 Irrevocable Trust, for which Mr. Hatsopoulos is the |

trustee; (3) 1,039,480 shares of common stock held by the Alexander J. Hatsopoulos 2011 Irrevocable Trust, for which Patricia Hatsopoulos, Mr. Hatsopoulos' wife, is the trustee; (4) 3,325 shares of common stock held in an individual retirement account for Mrs. Hatsopoulos; (5) 44,012 shares held in Pat Ltd., a joint account maintained by Mr. Hatsopoulos and Mrs. Hatsopoulos; (6) 28,225 shares of common stock held by Mrs. Hatsopoulos; and (7) options to purchase 12,723 shares of common stock held directly by Mr. Hatsopoulos. Does not include the following shares with respect to which Mr. Hatsopoulos disclaims beneficial ownership: (1) 808,339 shares of Common stock held in The John N. Hatsopoulos 1989 Family Trust for the benefit of Nia Maria Hatsopoulos, of which Ann Marie Pacheco is the sole trustee, (2) 812,325 shares of common stock held in The John N. Hatsopoulos 1989 Family Trust for the benefit of Alexander J. Hatsopoulos, or which Ms. Ann Marie Pacheco is the sole trustee, and (3) 579,749 shares of common stock held in The John N. Hatsopoulos Family Trust 2007, of which Mr. Yiannis Monovoukas is the sole trustee.

| |

(5) | Includes: (a) 163,350Based solely upon the Schedule 13G filed by Mr. Joseph Comeau on behalf of The Hatsopoulos 2012 Family Trust on May 22, 2018. The Schedule 13G states the beneficial ownership consists of 2,250,000 shares of Common Stock, directlycommon stock held by The Hatsopoulos 2012 Family Trust, of which Mr. Panora, and (b) options to purchase 125,000 sharesComeau is the sole trustee. The address of Common Stock exercisable within 60 days of April 27, 2016.the holder is Oliver St. Tower, 125 High St., Boston, MA 02110. |

| |

(6) | Based solely upon Schedule 13G filed by Mr. John N. Hatsopoulos on March 26, 2019. The Schedule 13G states the beneficial ownership of The John N. Hatsopoulos 1989 Family Trust consists of 1,620,646 shares of common stock, including 808,339 shares held for the benefit of Nia Marie Hatsopoulos, and 812,325 shares held for the benefit of Alexander J. Hatsopoulos. Ms. Ann Marie Pacheco is the sole trustee of the John N. Hatsopoulos 1989 Family Trust. The address of the holder is 45 First Ave., Waltham, MA 02451. Mr. John Hatsopoulos disclaims beneficial ownership of all shares held by the trust. |

| |

(7) | Based solely upon the Schedule 13G filed by Tryfon Natsis and Despina Pantopoulou Natsis on February 1, 2017. The Schedule 13G states the beneficial ownership as the following: 1,616,673 shares of common stock owned jointly by Tryfon Natsis and Despina Pantopoulou Natsis as spouses and joint tenants with the right of survivorship. The address for each holder is 36 Chemin Du Milieu, Collonge-Bellerive, Geneva, Switzerland 1245. |

| |

(8) | Includes: (a) 75,0003,418 shares of Common Stock, directly held by Mr. Benjamin Locke; and (b) 286,800 options to purchase Common Stock. |

| |

(9) | Includes: (a) 138,850 shares of Common Stock, directly held by Mr. Robert Panora; and (b) options to purchase 137,723 shares of Common Stock. |

| |

(10) | Includes: (a) 224,590 shares of Common Stock, directly held by Mr. Charles Maxwell, and (b) options to purchase 25,000 shares of Common Stock exercisable within 60 days of April 27, 2016.Stock. |

| |

(7)(11)

| Includes: (a) 9,044 shares of Common Stock, directly held by Mr. Keith Davidson; and (b) options to purchase 75,000 shares of Common Stock. |

| |

(12) | Includes: (a) 50,000 shares of Common Stock, directly held by Ms. Angelina Galiteva and (b) options to purchase 25,000 shares of Common Stock exercisable within 60 days of April 27, 2016.Stock. |

| |

(8)(13)

| Includes: (a) 25,000 shares of Common Stock, directly held by Mr. Ghoniem,Ahmed Ghoniem; and (b) options to purchase 25,00037,723 shares of Common Stock exercisable within 60 days of April 27, 2016.Stock. |

| |

(9)(14)

| Includes: (a) 8,5001,762 shares of Common Stock, held directly held by Mr. Garrison,Ms. Bonnie Brown; and (b) options to purchase 25,00024,200 shares of Common Stock exercisable within 60 days of April 27, 2016.Stock. |

| |

(10)(15)

| Includes:Includes options to purchase 68,7509,200 shares of Common Stock exercisable within 60 days of April 27, 2016.Stock. |

| |

(11)(16)

| Includes:Mr. Lewis and Ms. Garcia Roosevelt are nominees for election to the Tecogen Board of Directors. Based on Director and Officer Questionnaires signed by Mr. Lewis and Ms. Garcia Roosevelt, neither Mr. Lewis nor Ms. Garcia Roosevelt hold any Tecogen shares or options to purchase 12,500 shares of Common Stock exercisable within 60 days of April 27, 2016.acquire Tecogen shares. |

| |

(12)

| Includes: options to purchase 6,250 shares of Common Stock exercisable within 60 days of April 27, 2016. |

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information as of December 31, 2015,2018, regarding Common Stock that may be issued under the Company’s equity compensation plans.

|

| | | | | | | | | | |

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in second column) |

| Equity compensation plans approved by security holders | | 1,268,200 |

| | $ | 3.06 |

| | 1,614,533 |

|

| Equity compensation plans not approved by security holders | | — |

| | — |

| | — |

|

| Total | | 1,268,200 |

| | $ | 3.06 |

| | 1,614,533 |

|

This 2006 Stock Incentive Plan, or Plan, as amended, to date,or the Plan.

|

| | | | | | | | | | |

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in first column) |

| Equity compensation plans approved by security holders | | 1,292,589 |

| | $ | 3.52 |

| | 1,990,980 |

|

| Equity compensation plans not approved by security holders | | — |

| | — |

| | — |

|

| Total | | 1,292,589 |

| | $ | 3.52 |

| | 1,990,980 |

|

The Plan is intended to provide incentives to theCompany officers, directors, employees, and consultants by providing such individuals with opportunities to purchase stock in the Company pursuant to options granted hereunder which do not qualify as ISOs ("Non-Qualified Option"). The Board administers“Incentive Stock Options,” or “ISO” or “ISOs,” under Section 422(b) of the Plan, but allows for a single executive, currently Co-CEO John N. Hatsopoulos, to grant a limited numberInternal Revenue Code of 1986, as amended, or the “Code;” such options onbeing an annual basis.“NSO” or “NSOs”.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company's executive officers and directors, and persons who own more than fiveten percent of any publicly tradeda registered class of the Company's equity securities, to file reports of ownership and changes in ownership of equity securities of the Company with the SEC and the NASDAQ. Officers, directors, and greater-than-five-percentgreater-than-ten-percent stockholders are required by the SEC's regulations to furnish the Company with copies of all Section 16(a) forms that they file.

Based solely upon a review of Forms 3 and Forms 4 furnishedinformation provided to the Company during the most recent fiscal year, and Forms 5 with respect to its most recent fiscal year,from reporting persons, the Company believes that all such formsis not aware of any failure on the part of any reporting person to timely file reports required to be filed pursuant to Section 16(a) of the Exchange Act were timely filed, as necessary, by the executive officers, directors, and security holders requiredwith respect to file the same during the fiscal year ended December 31, 2015.2018 other than one Form 4 filed by Ms. Brown on June 1, 2018 which included an option grant dated January 15, 2018 as well as an option grant dated May 31, 2018.

CORPORATE GOVERNANCE

The Board of Directors

The number of directors of the Company is established by the Board in accordance with the Company's Bylaws. The exact number of directors is currently set at six by resolution of the Board.By-laws. The directors are elected to serve for one year terms, with the term of directors expiring each year at the annual meeting of stockholders; provided further, that the term of each director shall continuestockholders or until the election and qualification of a successor and be subject toor such director’s earlier death, resignation or removal.

The Company's Certificate of Incorporation and BylawsBy-laws provide that the authorized number of directors may be changed onlyestablished by resolution of the Board, and also provide that our directors may be removed only for cause by the affirmative vote of the holders of at least two thirds of the votes that all our stockholders would be entitled to cast in an annual election of directors, and that any vacancy on ourthe Board, including a vacancy resulting from an enlargement of our Boardincrease in the number of Directors, may be filled only by vote of a majority of our directors then in office.

Members of the Board discussed various business matters informally on numerous occasions throughout the year. There waswere three formal Boardboard meetings in person and two formal Board meetings by teleconference during 2015.2018. All current directors attended at least 75% of theall Board meetings, of our Board.except for Mr. Charlie Maxwell and Mr. Keith Davidson who missed one formal meeting, and Mr. Ahmed Ghoniem who missed two formal meetings. Independent directors endeavor to meet on a regular basis as often as necessary to fulfill their responsibilities, including at least twice annually in executive sessionsessions without the presence of non-independent directors and management.

Director Independence

The Company's common stock is listed on the NASDAQ stock exchange. The Board considers the status of its members pursuant to the independence requirements set forth in the applicable NASDAQ rules and applicable federal securities laws. Under these requirements, the Board undertakes a review at least annually of director independence. During this review, the Board considers transactions and relationships between each director or any member of his immediate family and the Company and its affiliates, if any. The purpose of this review is to determine whether any such relationships or transactions exist that are inconsistent with a determination that the director is independent. The following current directors, Ms. Galiteva, Dr. Aoun, Dr. Ghoniem and

Mr. Lewis are “independent” in each case as defined in the applicable NASDAQ rules. As of December 31, 2015, the members of the Compensation Committee, Audit Committee and Nominating and Governance Committee are also “independent” for purposes of Section 10A-3 of the Exchange Act and NASDAQ listing requirements. The Board bases these determinations primarily on a review of the responses of the directors and executive officers to questions regarding employment and transaction history, affiliations and family and other relationships and on discussions with the directors.

Board Leadership Structure and Role in Risk Oversight

The Company separates the roles of Co-ChiefChief Executive OfficersOfficer and ChairmanChairperson in recognition of the differences between the two roles. Our Co-ChiefChief Executive Officers areOfficer is responsible for setting the strategic direction for the Company and the overall leadership and performance of the Company. Our ChairmanChairperson provides guidance to the Co-ChiefChief Executive Officers,Officer, sets the agenda for Board meetings, presides over meetings of the full Board and leads all executive meetings of the independent directors. We are a small company with a small management team, and we feel the separation of these roles enhances high-level attention to our business. Our Board has no lead independent director.

Our Board oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements, and discusses policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which the Company’s exposure to risk is handled. The Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. The Nominating and Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, succession planning for our directors, and corporate governance.

Committees of the Board of Directors

Our Board directs the management of our business and affairs and conducts its business through meetings of the Board and the following standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee.

Audit Committee.Committee. The Audit Committee is presently composed of three members of the Board: Mr. Charles T. Maxwell (Chairman), Ms. Angelina M. Galiteva and Dr. Ahmed F. Ghoniem.Ms. Deanna Petersen. The Audit Committee assists the Board in the oversight of the audit of the Company’s financial statements and the quality and integrity of its accounting, auditing and financial reporting processes. The Audit Committee also has the responsibility of reviewing the qualifications, independence and performance of the Company’s independent registered public accounting firm and is responsible for the appointment, retention, oversight and, where appropriate, termination of the independent registered public accounting firm. During fiscal year 2015,2018, the Audit Committee held four meetings. The Board has determined that each of the members of the Audit Committee meets the criteria for independence under the applicable listing standards of NASDAQ, Section 10A-3 of the NASDAQ,Exchange Act, and that Mr. Maxwell also qualifies as an “audit committee financial expert,” as defined by the rules adopted by the SEC. The Board has adopted a written charter for the Audit Committee, which is reviewed annually by the Audit Committee. The current Audit Committee Charter is available on the Company’s web site,

http://investors.tecogen.com/audit-committee-charter.

Compensation Committee. The Compensation Committee is presently composed of threetwo members of the Board: Mr. Earl R. Lewis (Chairman), Ms. Angelina M. Galiteva (Chairwoman) and Dr. Joseph E. Aoun.Ms. Deanna Petersen. The principal functions of the Compensation Committee are reviewing with management cash and other compensation policies for employees, making recommendations to the Board regarding compensation matters and determining compensation for the Executive Officers. Our Co-ChiefChief Executive Officers have been instrumental in the design and recommendation to the Compensation Committee of compensation plans and awards for our directors and executive officers including our President and Chief Operating Officer and Chief FinancialAccounting Officer. All compensation

decisions for the Chief Executive Officers and all other executive officers are reviewed and approved by the Compensation Committee and can be subject to ratification by the Board of Directors. The Compensation Committee has the authority under its charter to engage the services of outside advisors, experts and others to assist the Compensation Committee. In 2015,2018, no compensation consultant was engaged for employee or executive compensation.During fiscal year 2015,2018, the Compensation Committee held no formal meetings. The Board has determined that each of the members of the Compensation Committee meets the criteria for independence under the applicable NASDAQ listing standards. The current Compensation Committee Charter is available on the Company’s web site at http://investors.tecogen.com/compensation-committee-charter.

Nominating and Governance Committee. The Nominating and Governance Committee is presently composed of three members of the Board: Mr. Ahmed F. Ghoniem (Chairman), Mr. Charles T. Maxwell and Dr. Joseph E. Aoun,Ms. Deanna Petersen, each of whom is an independent director as independence is defined by the NASDAQ rules and regulations. The Nominating and Governance Committee functions are to identify persons qualified to serve as members of the Board, to recommend to the Board of Directors persons to be nominated by the Board for election as directors at the annual meeting of stockholders and persons to be elected by the boardBoard to fill any vacancies and recommend to the Board persons to be appointed to each of its committees. Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing composition of our Board. However, minimum qualifications include high level leadership experience in business activities, breadth of knowledge about issues affecting the Company, experience on other boards of directors, preferably public company boards, and time available for meetings and consultation on Company matters. In addition, the

Nominating and Governance Committee is responsible for developing and recommending to the Board a set of corporate governance guidelines applicable to the Company (as well as reviewing and reassessing the adequacy of such guidelines as it deems appropriate from time to time) and overseeing the annual self-evaluation of the Board. The committee held no formal meetings in 2015.2018. The charter of the Nominating and Governance Committee is available on the Company’s website at http://investors.tecogen.com/nominating-and-governance-committee-charter.

Nominations and Proposals of Stockholders

The Company’s Nominating and Governance Committee identifies new director candidates through recommendations from members of the Committee, other Board members and executive officers of the Company and will consider candidates who are recommended by security holders, as described below. Although the Board does not have a formal diversity policy, the Committee and the Board will consider such factors as it deems appropriate to assist in developing a Board and committees that are diverse in nature and comprised of experienced and seasoned advisors. These factors focus on skills, expertise or background and may include decision-making ability, judgment, personal integrity and reputation, experience with businesses and other organizations of comparable size, experience as an executive with a publicly traded company, and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board.

A stockholder who, in accordance with Rule 14a-8, or Rule 14a-8, under the Securities Exchange Act of 1934, as amended, or the Exchange Act, wants to present a proposal for inclusion in the Company's 20162019 Proxy Statement and proxy card relating to the 20162019 Annual Meeting of Stockholders must submit the proposal by January 1, 2016.December 20, 2018. In order for the proposal to be included in the Proxy Statement, the stockholder submitting the proposal must meet certain eligibility standards and comply with certain regulations established by the SEC.

Stockholders who wish to present a business proposal or nominate persons for election as directors at the Company's 20162020 Annual Meeting of Stockholders must provide a notice of the business proposal or nomination in accordance with Section 1.11 of our Bylaws,By-laws, in the case of business proposals, or Section 1.10 of our Bylaws,By-laws, in the case of director nominations. In order to be properly brought before the 20162020 Annual Meeting of Stockholders, Sections 1.10 and 1.11 of our BylawsBy-laws require that a notice of the business proposal the stockholder wishes to present (other than a matter brought pursuant to Rule 14a-8), or the person or persons the stockholder wishes to nominate as a director, must be received at our principal executive office not less than 90 days, and not more than 120 days, prior to the first anniversary of the Company's prior year's annual meeting. Therefore, any notice intended to be given by a stockholder with respect to the Company's 20162020 Annual Meeting of Stockholders pursuant to our BylawsBy-laws must be received at our principal executive office no earlier than February 12, 20166, 2019 and no later than March 13, 2016.8, 2019. However, if the date of our 20162019 Annual Meeting of Stockholders occurs more than 3020 days before or 3060 days after June 11, 2016,6, 2019, the anniversary of the 20152018 Annual Meeting of Stockholders, a stockholder notice will be timely if it is received at our principal executive office by the later of (1) the 120th day prior to such annual meeting or (2) the close of business on the tenth day following the day on which public disclosure of the date of the meeting was made. To be in proper form, a stockholder's notice must include the specified information concerning the stockholder and the business proposal or nominee, as described in Sections 1.10 and 1.11 of our Bylaws.By-laws.

All proposals must be mailed to the Company's principal executive office, at the address stated herein, and should be directed to the attention of the Secretary of the Company.

The Nominating and Corporate Governance Committee will evaluate new director candidates in view of the criteria described above, as well as other factors the Committee deems to be relevant, through reviews of biographical and other information, input from others, including members of the Board and executive officers of the Company, and personal discussions with the candidate when warranted by the results of these other assessments. The Committee will evaluate any director candidates recommended by security holders under the same process. In determining whether to recommend to the Board the nomination of a director who is a member of the Board, the Committee will review the Board performance of such director and solicit feedback about the director from other Board members.

Code of Conduct and Ethics

The Company has adopted a code of business conduct and ethics that applies to the Company’s directors, officers and employees. The Company’s code of business conduct and ethics is intended to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with, or submits to, the SEC and in other public communications made by the Company; compliance with applicable governmental laws, rules and regulations; prompt internal reporting of violations of the code of business conduct and ethics to an appropriate person or persons identified in the code of business conduct and ethics; and accountability for adherence to the code of business conduct and ethics. The Company’s code of business conduct and ethics is available on the Company’s website at http://investors.tecogen.com/code-of-business-conduct-and-ethics.ir.tecogen.com/governance-docs. A printed copy of the Company's code of business conduct and ethics is also available free of charge to any person who requests a copy by writing to our Secretary, Tecogen Inc., 45 First Avenue, Waltham, MA 02451.

REPORT OF THE AUDIT COMMITTEE

The information contained in this Proxy Statement with respect to the Audit Committee Report and charter and the independence of the members of the Audit Committee shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the “Securities Act”“Securities Act”, or the Exchange Act, except to the extent that the Company specifically incorporates it by reference in such filing.

The Company has an Audit Committee that is comprised of independent Directors. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the accounting firm that is engaged as the Company’s independent registered public accounting firm. The Company’s management is responsible for the Company’s internal controls, disclosure controls and financial reporting process. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States.

In the performance of the Audit Committee’s oversight function, we have reviewed and discussed with management the Company’s audited financial consolidated statements of the Company for the fiscal year ended December 31, 20152018 and management’s assessment of the effectiveness of the Company’s internal control over financial reporting. We have also discussed with the Company’s independent registered public accounting firm the matters requiring discussion pursuant to Statement on Auditing Standards No. 61, as amended (Communications with Audit Committees) and as adopted by the Public Company Accounting Oversight Board in Rule 3200T and such other matters as we have deemed to be appropriate. We have also discussed with the Company’s independent registered public accounting firm matters relating to its independence and have received the written disclosures and letter from it required by the applicable requirements of the Public Company Accounting Oversight Board.